2018/12/6 9:38:55 3110

In 2018, this industry faced headwinds from a new quarter: Governments, as if wasn’t enough dealing with evermore demanding markets, competing materials and consumerist scares based on bad science.

The year began badly with Donald Trump forcing through new tariffs on imports of steel and aluminium into what is still by far the largest volume market for metal packaging in the world.Contrary to some Republican senators’ expectations (what were they thinking?)this resulted in a rise in all metal prices, including domestic manufacture. As the US steel industry does not supply the whole range of specifications needed for cans (wide coil DWI, for instance), the measure was of doubtful use anyway.

Then came the tit for tat tariff war between the US and China. The first US wave was aimed at industrial machinery,snaring up most can-making and filling equipment in its path, and the second wave a whole range of consumer goods, including metal cans and ends and glass bottles. The next threatened wave would cover all of China’s exports to the US,with damaging effect on both sides, including US companies with production facilities in China. Fortunately for SLAC, we are already physically present with manufacturing facilities in the US: SLAC Americas in Dayton and OKL Engineering in Cincinnati, acquired a few months before the new iron curtain arrived.

In the same year the US pulled out of its international agreements with others, re-imposing sanctions that were removed six years ago, and killing off the prospects of creating a modern consumer market to meet the needs of this young and dynamic population.

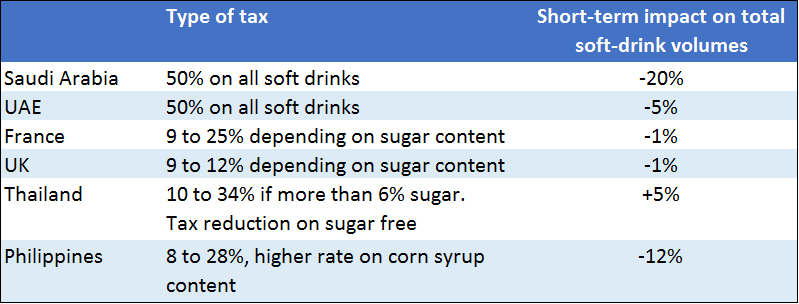

Taxes on soft drinks opened up another Government-inspired headwind, with many more countries taking advantage of the opportunity to fill state coffers under the cover of good intentions. The actual impact has been variable. In France and more recently the UK, the new taxes were intelligently devised and implemented, resulting in a reduction in sugar content and a massive switch to low or no sugar beverages. Mineral water and ‘water plus’ drinks have grown sharply, and the volume of the overall market for soft drinks has hardly been impacted.

On the other end of the scale, Saudi Arabia and the UAE introduced heavy taxation indiscriminately on all soft drinks,regardless of sugar content, and overall sales fell sharply.

In Thailand the new taxes are proportional to sugar content, and are being introduced gradually, with no visible effect so far on overall consumption. In the Philippines the new taxes have fallen heavily on soft drinks using corn syrup, with a resulting drop in sales volumes on high volume, low-cost brands such as RC Cola.

There are now more eleven countries and five US states with sugar taxes in place, and several more considering introduction in the months to come, with no guarantee that the intelligent models will be chosen and overall soft drinks volumes protected.

Against all these headwinds the industry fortunately is faced with one favourable wind which outblows them all: the fall from favour of plastic packaging. Plastic packaging has been the darling of marketing departments for many years, the material with its bright colours,light weight, soft touch and distinctive shapes, that was going to replace old-fashioned metal and other traditional substrates.

And then came David Attenborough’s Blue Planet II, the most watched TV programme in the UK in 2017, seen and re-seen millions of times, not just in the UK, but round the world. The evidence of the pollution and damage caused by plastics to marine life, and the fact that the plastics are steadily accumulating without being recycled, came as a shock to consumers and has been responsible for a complete reversal of plastic’s previously favourable image. There is always a lag between a change in perception and actual changes in behaviour, and the plastics apologists can always point to evidence of continuing growth. But there are signs that changes will be happening soon. The UK is considering a plastics tax (is plastic the new ‘sin’?); the European Parliament recently passed a bill advocating the phasing out of all one-way plastic packaging by 2025, a Dutch supermarket chain has a non-plastics corner in its 93 supermarkets and (my personal favourite) plastic bottles have been banned in all of the Queen’s properties in the UK. The fact is that there is no easy path for today’s consumer to switch out of plastic, which has become useful and even indispensable in everyday life. It is difficult to see how the largest volume plastic packaging item by far, the omnipresent 2-litre plastic bottles of mineral water, can be replaced by metal, or glass, or returnable plastics. As for recycling, current rates are low, because unlike glass and metal, it has no economic value.

The plastics producers are clearly in a near impossible situation, complicated by the fact that today the producers are mainly the brand owners and fillers themselves, who integrated blow-moulding and even preform production into their internal systems long ago (and virtually wiping out the PET bottle industry in the process)

This is undoubtedly a major historic opportunity for metal packaging. Metal has very high recycling rates worldwide,and recycled metals have a high economic value. Post-consumer aluminium scrap today has a value of about 60% of the LME, so around $1200/tonne. Plastic waste used to have a value of $20/tonne, but now you have to pay $10/tonne to have it taken away, not surpirising perhaps now that the Chinese have all but stopped importing any plastics for recycling.

Plastic packaging is of course supported by its low cost. But what would happen if it had to support the real cost of recycling? It is time to end the gentlemanly agreement prevalent in many countries which spreads the cost of recycling over all materials, which essentially means that metal is subsidizing plastic. True costing would significantly narrow the cost gap between the two materials and would let economic forces contribute to solving the recycling problem.

The vast scale of the PET bottle consumption means that even ‘small crumbs’ from their table will have a dramatic effect on metal packaging volumes. The most immediate targets are the growing sectors: flavoured mineral waters, low or no sugar fruit beverages,ready to drink herbal teas, protein drinks. Why should any of these be in plastic? How they can hold a ‘new age’ image when their plastic bottles can be seen floating down the river or in the mouth of a suffocated seabird?

To take advantage of this opportunity, the industry does not need to spread negative press on plastics; the damage is self-inflicted and needs no emphasis. But it should stress the multiple benefits of metal, not just in recycling, but also in metal’s growing ability to match plastic’s features: shaping, lightweight, soft touch and other special textures, photographic quality images and colours, re-sealability.

At SLAC we stand ready to help can-makers seize the opportunity. For high volume beverage can lines, we now produce internally most of the equipment in a typical line, from cuppers and bodymakers through to necking and palletizers. This gives us the scale which makes Capex budgets go further and facilitates access to low-cost DWI technology.

Many of the new market opportunities are likely to be from smaller volume ranges, with many variants, in average run sizes which in the past would have precluded DWI. For this reason SLAC has developed mini-line concepts around SLAC’s new digital printer, which lowers the traditional volume threshold for DWI and opens up low-cost opportunities for annual volumes of 75m cans, ten times less than the generally accepted minimum for conventional DWI. New age soft drinks, craft beers, flavoured mineral waters, monobloc aerosols and printed food cans could all benefit from this new approach.

And finally we are striving to make technology access easier by moving to the next level of line productivity.Inspired by the extraordinarily intelligent methods developed by bees over millions of years to produce honey efficiently, The Hive Initiative™ is SLAC’s project to develop machine intelligence in the world of can-making. Most modern lines already have sophisticated equipment for tracking the quality of the can as it is produced in-line, usually through vision systems. With The Hive Initiative,this will be extended to tracking the equipment itself, on all of the multiple critical control points that define ultimate quality. SLAC machines with the Hive logo will be fitted with sensors and cameras continuously monitoring oil temperature and pressure, tooling wear out, vibration and alignment, and other parameters. The information collected will raise alerts where a part of the line is drifting out of specification before it has an impact on product quality, suggest remedies, and in some cases self-adjust, without requiring human intervention.

Tables and images (optional)

The Hive Initiative™

official account

official account